Understanding CapEx: Turning Bricks Into Balance Sheets is crucial to business owners who wish to realize the true worth of the physical investments. The investment in physical assets not only influences the balance sheet but also the long-term growth and strategy. Such investments are strategized by companies in order to remain competitive and stay afloat.

It is through these trends that the executives will be able to anticipate future requirements, implement improved decision-making, and effectively allocate resources.

This article will explain what is CAPEX, its use in the balance sheet, and its importance in expanding your business. At the conclusion, you will realize its relevance and how intelligent investment planning can make your business successful. In addition, smart investors often explore the benefits of choosing the best computer course to strengthen their financial planning skills.

Defining the Basics

What is CapEx?

CapEx is used to refer to expenditure incurred to purchase, upgrade, or maintain long-term physical assets. It consists of structures, equipment, and automobiles, and technology that aid in operations. CapEx is considered an investment in capacity in the future rather than a cost that firms may incur at a point in time. Consequently, companies actively budget for technology upgrades such as recent updations in Google Cloud Platform to keep operations efficient.

CapEx meaning in business growth

CapEx meaning is more than expenditure; it means planning to grow. It is an indication that the management wants to expand production, develop new products, or become more efficient. To determine the future revenue potential and positioning, investors follow CapEx. Because of this, managers consistently track Microsoft Excel training software to forecast balance-sheet impacts with precision.

So if you have understood the CapEx meaning, there is a chance you will be able to utilize this to grow your business. Thus, entrepreneurs quickly convert insights into action to accelerate growth.

Difference: CapEx vs OpEx

| Feature | CapEx (Capital Expenditure) | Opex (Operational Expenditure) |

| Purpose | Improves assets over time | Covers daily operational costs |

| Accounting Treatment | Appears on the balance sheet | Reduces profit immediately |

| Impact | Long-term investment | Short-term expense |

| Financial Reporting | Capitalized and depreciated over time | Expensed in the period incurred |

| Importance | Ensures growth and asset value | Ensures smooth daily operations |

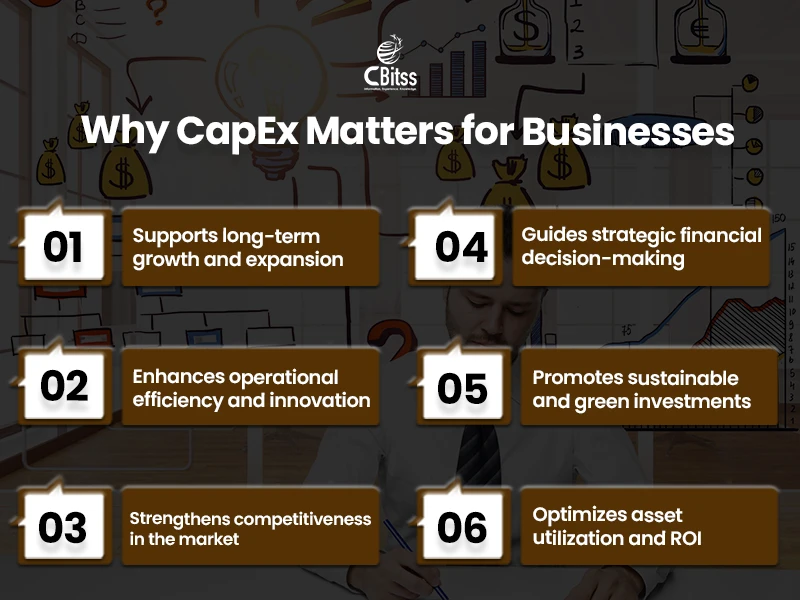

Why CapEx CapEx Matters Today

Understanding CapEx: Turning Bricks Into Balance Sheets reveals its strategic importance.

The planned CAPEX leads to increased efficiency, innovation, and competitiveness. Bad management of this can result in underutilization of assets or financial pressure. Firms use these trends to attract capital and creditworthiness. Moreover, proper CAPEX planning assists companies in predicting their future growth requirements and maximizing the allocation of resources. It also gives a clear road map to strategic decision-making as well as long-term sustainability. Meanwhile, digital marketers highlight how Google Ads can also help you in leading organic search result when planning CapEx for online campaigns.

New Perspectives on CapEx

CapEx and Digital Infrastructure

- Companies are putting more CapEx in AI, robotics, cloud, and automation.

- Digital assets enhance the efficiency of operations and increase the innovation speed.

- Early investment in new technology is a competitive advantage in the years. Hence, businesses explore the future scope of Python to support AI-driven infrastructure.

CapEx and Green Economy

- Sustainable CapEx encompasses the non-renewable energy projects, waste minimization, and energy-efficient plants.

- Businesses repurpose plants to minimize emissions and lower the operational expenses in the long term.

- Green investments also build brand image and trust among stakeholders. As a result, companies carefully avoid web design turn-offs that might damage eco-friendly branding online.

CapEx and Human-Centric Workplaces

- Industry 5.0 lays stress on employee-oriented, flexible, and adaptive infrastructure.

- CapEx embraces hybrid offices, ergonomic offices, and wellness-based designs.

- Companies that invest in people-oriented spaces achieve better productivity and retention. Consequently, leaders integrate object-oriented programming concepts into workplace automation systems for long-term scalability.

CapEx in Edge Cities

- Infrastructure in the firms is diverted to tier-II and tier-III cities.

- Edge facilities lower the logistics expenses and improve the efficiency of supply chains.

- Smaller cities tend to offer less construction and faster approvals of the project. Therefore, investors act swiftly to capture first-mover advantages.

CapEx CapEx Outlook for 2026 and Beyond

Technology: AI, Automation, and Robotics

Global adoption of AI drives massive CapEx increases in data centers and automation.

Automation of robots lowers labor expenses and increases productivity.

To achieve growth into the future, companies need to plan capital expenditure today on hardware that will provide that growth.

Energy: Renewables and Climate-Resilient Infrastructure

- CapEx concentrates on flood-resistant plants, smart grids, and renewable energy more and more.

- Investments that are climate-conscious will minimize exposure to extreme weather conditions.

- Sustainability Energy-saving infrastructure reduces the cost of operation.

Real Estate: Smart Buildings and Modular Construction

- Real estate CapEx concentrates on intelligent, modular, and retrofit-ready buildings.

- Companies invest in automation, IoT sensors, and dynamic designs to be flexible in the future.

- Scalable buildings enable companies to grow without significant rebuilding.

Global Shifts: Reshoring and Infrastructure Hubs

- Companies budget CapEx to re-source supply chains that are more local to the consumers.

- The emergence of new manufacturing and distribution centers shortens shipping time and transportation expenses.

- This direction helps to reduce global trade risks and geopolitical ones.

CapEx Planning Framework

Scenario Planning

- Base case: The moderate growth and planned investment.

- Optimistic scenario: IT returns get faster with technology adoption.p

- Pessimistic case: Macro risks cause a slowdown in the use of assets.

- Stress case: The unforeseen changes in regulation or in the market are costly.

- New product lines or processes: The innovation needs further investment.

- Case of efficiency: It is achieved by lean operations and automation.

Stakeholder Engagement

These priorities are informed by departments like operations, IT, and human resources. Early involvement avoids wastage of money and makes it business-strategy compliant. Engagement of finance teams will contribute to the evaluation of the feasibility of the budget and predict ROI. Interdepartmental collaboration also determines the possible risks and source gaps. Such a cross-functional strategy will make sure these decisions can support short-term efficiency and long-term growth goals.

Monitoring Megatrends

Digitalization, sustainability, and demographic shifts influence its allocation. Companies that monitor trends will be able to know about early investment opportunities and prevent obsolescence. As an illustration, the implementation of green technologies can lower the cost of operations in the long run and fulfill the regulatory demands. Monitoring the development of technology will make equipment and infrastructure competitive. Demographic data make it possible to predict workforce demand and facility growth. When the companies act before these megatrends, they will be able to reinforce their place in the market and be innovative. Agile changes in these plans can also be effected through continuous monitoring of the emerging risks and opportunities.

Risk Evaluation

The currency changes, regulatory changes, and unproductive technology need to be factored into these plans. A sound risk framework conserves capital and guarantees the success of a project in the long term. Periodic situation analysis assists in predicting possible crises and adjusting the strategies in advance. The risk assessment process that involves cross-functional teams also enhances the decision-making process and reduces unanticipated issues.

Numerical Insights: Preparing Future CapEx

Three Mistakes to Avoid

- Overestimating ROI from untested technology investments.

- Ignoring maintenance and operational costs in long-term CapEx.

- Failing to align projects with strategic goals.

Four Strategies for Sustainable CapEx

- Invest in modular and adaptable infrastructure.

- Prioritize energy efficiency and green technologies.

- Monitor asset utilization to optimize returns.

- Maintain a clear separation of CapEx vs OpEx for transparency.

Five Industries with Rising CapEx After 2026

- AI and automation technology.

- Renewable energy and utilities.

- Manufacturing Industry 5.0.

- Logistics and smart transportation.

- Healthcare and digital hospitals.

Industry-Wise Predictions

- Technology and AI: Continuous hardware upgrades and cloud expansions.

- Utilities and Energy: Smart grids and renewable capacity growth.

- Production: flexible, automated manufacturing with sustainable materials.

- Logistics and Transportation: Last-mile infrastructure and autonomous vehicles.

- Healthcare: Digital hospitals, AI diagnostics, and smart medical facilities.

- Retail: Multichannel shops, robots in warehouses, and artificial intelligence in stock.

- Telecommunications: 5G network expansion, fiber optic deployment, and IoT infrastructure.

- Finance & Banking: Data centers, cybersecurity systems, and AI-driven financial platforms.

Summary Table: CapEx 2026 Trends

| Sector | 2026 CapEx Focus | Example Type |

| Technology | AI, cloud, robotics | Data centers |

| Energy | Renewables, smart grids | Solar/wind plants |

| Real estate | Smart buildings, modular | Offices & warehouses |

| Manufacturing | Automation, sustainability | Flexible plants |

| Healthcare | Digital & physical | Smart hospitals |

Conclusion

Understanding CapEx: Turning Bricks Into Balance Sheets equips firms to make strategic investments.

There is a need to have proper CAPEX planning to sustain growth, maintain sustainability, and be competent in the long run.

Companies that act as pioneers by balancing their expenses with new developments would have an edge over the market. The future requires investments in adaptive, resilient, and human-based infrastructure to keep pace and provide for the changing business and societal demands.

Interested in why intelligent CAPEX planning is essential to the financial development of your business?

Become part of our training program so that you can learn accounting training to know how to plan to invest in the future with digital, green, and flexible investments, 2026 and beyond.

Learn how to maximize returns, reduce risks, and future-proof your balance sheet in addition to joining the next generation of wealth-wise professionals. Finally, strengthen your technical base by exploring practical resources like the benefits of choosing the best computer course and other advanced learning options.